NewsRescue

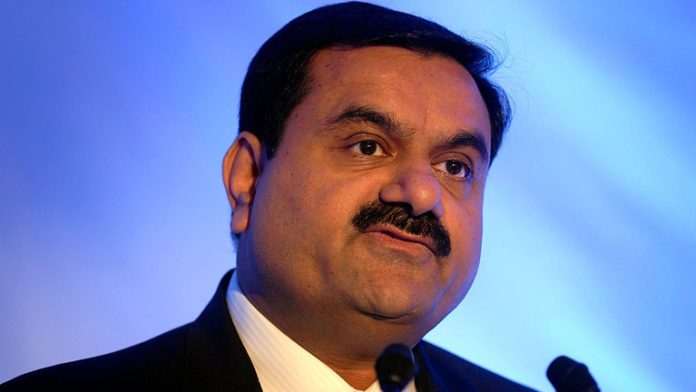

Gautam Adani, an Indian billionaire, has accused Hindenburg Research of a “deliberate and malicious attempt” to tarnish the name of his company, Adani Group.

Adani Group was called the worst corporate scam in history by Hindenburg in January, accusing it of long-running stock manipulation and accounting fraud. The claims have been refuted by Adani Group.

Adani stated at the annual general meeting of the group’s main firm Adani Enterprises on Tuesday that the report attempted to profit from the dip in Adani Group’s stock prices.

“The majority of the allegations were made between 2004 and 2015.” They were all resolved at the time by the right authorities… While we soon released a full refutation, several vested interests attempted to exploit the short seller’s assertions [Hindenburg Research]. “These entities encouraged and promoted false narratives on a variety of news and social media platforms,” he said.

Adani stated that a Supreme Court Expert Committee investigating Hindenburg’s charges found no proof of the group’s stock-price manipulation.

“The committee’s report not only observed that the company’s mitigating measures helped rebuild confidence, but also cited credible charges of targeted destabilization of Indian markets,” Adani added.

Adani applauded investors who did not desert the firm in the aftermath of Hindenburg’s allegations.

“Our track record is self-evident. I am appreciative for the support our stakeholders provided us during these difficult times. It is also worth mentioning that no rating agency reduced our ratings during this period. “This is the strongest validation of investor confidence in Adani Group companies,” he said.

The Hindenburg report sparked a stock market crash that robbed Adani Group around $145 billion in market value at its lowest point. It also caused Gautam Adani’s personal fortune to drop by up to $69 billion, or approximately 60%.