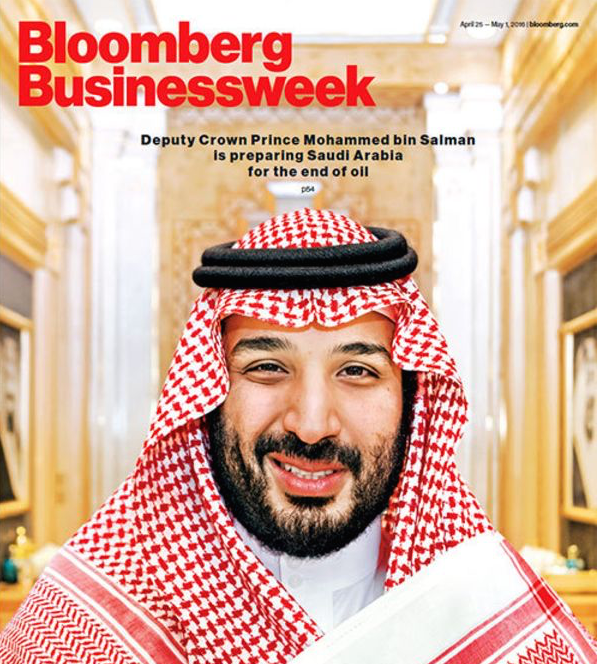

Saudi Arabia’s Crown Prince Mohammad bin Salman, also known as MbS and seen as the de facto ruler of the kingdom, has suffered a major blow to his wishful plans for building a modern (westernized) and economically vibrant country after attacks on state-run Aramco’s oil installations earlier this month as investors are no longer interested in buying the shares of the company.

Recent reports in the media suggest that the September 14 attacks by Yemen’s ruling Ansarullah movement on oil facilities east of Saudi Arabia have seriously changed valuation estimates for Aramco, the largest oil company in the world.

Saudis had been hoping to raise at least $100 billion from a five-percent listing of Aramco, a company that had been valued around $2 trillion before the attacks by the Yemenis.

The initial public offering (IPO) for Aramco came after bin Salman, a controversial figure who has been at the heart of news on Saudi Arabia over the past years, launched an ambitious plan for diversifying the Saudi economy and to make it less dependent on oil.

The Vision 2030 has been touted by the Western governments, who support bin Salman, as a major sign of willingness in Saudi Arabia to attain progress and economic prosperity.

However, reports suggest bin Salman’s plan is now in real tatters as it had been expected to rely on the cash generated through Aramco’s IPO.

PressTV-‘Saudi Arabia places order for Iraq oil imports’A report shows Saudis are looking for oil imports from Iraq amid disruptions caused to production.

Sources from Saudi Arabia’s energy ministry said last week that authorities were considering to delay Aramco’s listing in the domestic stock exchange, adding that plans for selling shares of the company on an international exchange were in real doubts.

That comes as attacks on Abqaiq and Khurais oil facilities have reportedly cut Saudi Arabia’s oil production in half, forcing the government to tap its huge reserves to keep exports smooth and running.

Experts believe it would take months for the Saudis to repair the damage inflicted on the oil processing facilities in the recent drone attacks although Riyadh insists production would be restored to normal levels by the end of September.

Other reports have suggested that bin Salman and his inner circle have been pressuring rich families in Saudi Arabia to buy shares of Aramco to help provide the money needed for the young prince’s ambitious plans.

Those families, however, have shown no real interest in the Aramco’s IPO scheme amid growing uncertainties about the future of the company, which is also called the Saudi Arabian Oil Company.

Analysts and bankers had believed before the Yemeni attacks that Aramco’s valuation at $2 trillion was unrealistic, saying $1.5 trillion would be more achievable.

However, further devaluation caused by the attacks would mean that bin Salman and the Saudi government would earn nothing more than $10 billion in an initial floating of Aramco which would include a sell-off of one percent of the shares of the company.

https://www.presstv.com/Detail/2019/09/23/606939/Saudi-Arabia-oil-attacks-Prince-Salman-vision-plan