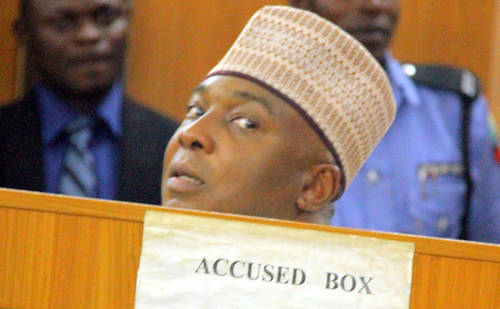

EXCLUSIVE: How EFCC linked Saraki, aides to N3.5 billion Paris Club refund

by Samuel Ogundipe,

On Sunday, Nigerians learnt of an explosive report the Economic and Financial Crimes Commission forwarded to President Muhammadu Buhari about alleged corrupt practices by the Senate President, Bukola Saraki.

In the March 10 correspondence to the president, the anti-graft agency detailed how Mr. Saraki — in connivance with his aides and associates – allegedly laundered N3.5 billion traced to the Paris Club loan refund to states.

Investigators say Mr. Saraki enlisted the service of a consultant, Robert Mbonu of Melrose General Services Limited, and Kathleen Erhimu, a staff of Access Bank to liaise with his aides and associates to launder the fund.

The accused persons are: Mr. Saraki’s Deputy Chief of Staff, Gbenga Makanjuola, and Obiora Amobi, Kolawole Shittu and Oladapo Idowu. (Are these guys named in the letter sent by Magu to Buhari?)

When allegations of diversion of parts of the over half a trillion naira Paris Club refund money emerged in February, sparking nationwide controversy, state governors denied misusing the money, and slammed the EFCC’s reported probe as “unwarranted attack on the Nigeria Governors’ Forum, its officials and associated entities”.

Mr. Saraki swiftly dismissed reports linking him to the money as “concocted”, and accused the EFCC acting head, Ibrahim Magu, of being the source of its leak.

But the report to President Buhari, seen by PREMIUM TIMES, provides details of a complex web of questionable money transfers, which investigators say ended with the Senate president.

The report, as well as interviews with officials, also offers some response to the widely-asked question of how Mr. Saraki allegedly became linked to the funds, despite not being a governor. State governor were the direct recipients of the money on behalf of their states.

Paris Club Loan Refund

The Nigerian government reached a debt relief deal with Paris Club in 2005, and paid $6.2 billion to guarantee a debt relief of up to $18 billion, according to the to Debt Management Office.

But not long after the deal was reached, some states and local governments began raising questions about possible over-deductions of their share of the loan repayment. They argued that the deducted amount did not reflect their actual borrowings from Paris Club between 1995 and 2002.

Many states initially hired consultants to help pursue a refund, but later resolved to engage a consortium of consultants for coordination.

Reconciliation of accounts and negotiations established that over-deductions took place, but states were unsure of how much each state or local government was overcharged.

The complex account reconciliation reportedly made it difficult for the previous governments of Olusegun Obasanjo, Umar Yar’Adua, and Goodluck Jonathan, to settle the matter.

However, the current Minister of Finance, Kemi Adeosun, said records showed some states received some refund under previous administrations.

To help states pay workers and retirees, Mr. Buhari, who took office two years ago, continued the reconciliations.

As the reconciliation process was still ongoing, the government pegged initial payments at 50 percent of the estimated excess to the claimants, Mrs. Adeosun said.

The payments were surprisingly not budgeted for by the f

ederal government, meaning they did not receive the constitutionally-required authorization of the National Assembly.

SHADY DEAL

Last December, the Ministry of Finance commenced transfers to states. All 36 states received between N4 billion and N15 billion.

Sources familiar with the deal told PREMIUM TIMES that shortly before the ministry commenced transfer after all paperwork had been completed, governors decided to warehouse some of the money —about N17 billion— in the Nigeria Governors’ Forum.

According to the sources, the governors hoped to use the money to settle consultants who worked for the refund.

The governors also anticipated a backlash from the National Assembly which might have complained because the refund was not captured in either the 2016 or 2017 budgets.

Our sources said the governors also made plans for the lawmakers.

After apportioning each state’s contribution based on the amount of refund the federal government was going to pay, the 36 governors signed an instruction that the Ministry of Finance remove their respective share of the N17 billion and credit it to the NGF account domiciled at Access Bank.

After the deduction, which is only a fraction of the total sum accrued to each state, the rest of the fund went to the treasury of respective states.

Ms. Adeosun said the governors agreed to spend at least 50 per cent of the funds to their state to settle salary arrears and pensions.

“Disbursement was subject to an agreement by state governments that 50% of any amount received would be earmarked for the payment of salaries and pensions,” the minister said last week.

Our sources believe this questionable deductions partly explained why the finance ministry refused to make public full details of payments to states, contradicting the Buhari administration promise of transparency.

SETTLEMENT OF CLAIMS

Following the deposit of N17 billion into its account, several consultants, lawyers and others began inundating the NGF with requests, officials said.

Although the NGF did not list the names of all those that qualified for settlements, the body confirmed that Melrose General Services Limited was amongst firms that provided services.

The NGF said in a statement that Melrose was paid N3.5 billion after the company “diligently delivered on its contractual obligations.”

But the EFCC, during investigation, uncovered how the director of Melrose, Robert Mbonu, allegedly initiated a series of bank transfers to individuals connected to Mr. Saraki.

A part of the EFCC’s report reads: “Mr. Robert Mbonu is alleged to have received the sum of N3.5billion into his company’s account (Melrose General Services Limited) from the NGF through Account 0005892453 domiciled in Access Bank.

“Investigation revealed that one Kathleen Erhimu is the Relationship Manager to Dr. Bukola Saraki’s account with Access Bank.

“That Saraki at a meeting introduced one Joseph Oladapo Idowu and Gbenga Peter Makanjuola to her and Hon. Makanjuola thereafter introduced Mr. Robert Mbonu to Ms Kathleen Erhimu.

“That Mbonu operates an account, Melrose General Services with Access Bank Plc 0005892453 and 0005653500 which was up till 13th December a business account.

“That Halima Kyari, the Head of Private Banking Group stated in a letter dated 13th December 2016, Mr. Robert Mbonu requested a transfer of Melrose General Services Company account from Business Account to a Private Banking Group Platform as he was expecting huge funds into the account.

“Subsequently, on the 14th December, the sum of N3.5 billion was lodged into Melrose General Services Company account number 0005892453 domiciled in Access Bank from the Nigerian Governors Forum (NGF).

“That thereafter Mr. Obiora Amobi and Hon. Gbenga Makanjuola were introduced to Access Bank as representatives of Melrose General Services Limited by Robert Mbonu to enable them cash withdrawals from the account.

“That Mr. Obiora Amobi and Gbenga Makanjuola made cash withdrawals of various tranches of N5million and N10million.

“That one Oluyemi Braithwaite, the MD/ CEO of Reinex Bureau de Change, Caddington Capital Limited and Westgate Limited also manages a BDC stated to have known Mbonu as a client and he requested for dollars in exchange for the Naira equivalent which were to be handed over to one Mr. Gbenga in Abuja.

“That Ms. Oluyemi Braithwaite contacted one Hassan Dantani Abubakar, the owner of Hamma Procurement Limited, Ashrab Nigeria Limited and Insoire Solar Application to make available the dollars based on the Naira equivalent as transferred from Robert Mbonu who she had introduced via phone to Hassan Dantani.

“That on 16th December 2016, Melrose General Services transferred the sum of N246million to Hamma Procurement First Bank account No. 2030756168 in exchange for the sum of $500,000 which was handed to one Mr. Gbenga in Abuja who acknowledged receipt of the same amount.

“That on the 21st Dec 2016, Ms Oluyemi Braithwaite contacted Hassan Dantani Abubakar requesting for another transaction of $370,000. Melrose General Services Company transferred the sum of N181m to Inspire Solar Application. The $370,000 was handed over to one Mr. Dapo in Abuja.

“That on the 4th of January 2017, Mbonu through Melrose General Services Company transferred the sum of N248, 500,000 to Caddington Capital Limited belonging to Ms Oluyemi Braithwaite who transferred same to Hassan Dantani Abubakar’s FCMB account, Ashrab Nigeria Limited for the sum of $500,000. The dollar equivalent was handed over to Mr. Kolawole Shittu in Abuja.”

Another part reads: “Investigations further revealed that prior to this transaction in xxii above, Xtract Energy Services Ltd. routinely made deposits into Dr. Bukola Saraki Access Bank United States dollar domiciliary account number: 0059429296 as follows: September 17, 2013, the sum of $80, 235.00, September 12, 2014, the sum of $96,930.00, November 18, 2014, the sum of $99,918.50 and December 19, 2014, the sum of $49,965, respectively.

“That Bosun Ottun further stated deposits into Dr. Bukola Saraki Access Bank United States Domiciliary Account Number: 0059429296 as follows: September 17, 2013, the sum of $80, 235.00, September 12, 2014, the sum of $96,930.00, November 18, 2014, the sum of $99,918.50 and December 19, 2014, the sum of $49,965 were brought to his company by Mr. Tunde Morakinyo who claimed that the funds were payments into Dr. Bukola Saraki’s card account.”

The EFCC further noted that: “Based on the foregoing findings, it is clear that Robert Mbonu, the Managing Director of Melrose General Services Company and his company were used to help divert proceeds of unlawful activities under the guise of payment for contractual obligations with the Nigerian Governors Forum (NGF).

“Suffice to apprise that all payments received by Melrose General Services Company from the NGF have hitherto been diverted directly via cash withdrawals and indirectly through transfers by Hon. Gbenga Peter Makanjuola, Kolawole Shittu and Oladapo Joseph Idowu who are principal aides of the Senate President.”

NGF denies wrongdoing

Although the NGF admitted it paid out the N3.5 billion to Mr. Mbonu’s firm, the organisation said it knew nothing about how the money was spent afterwards.

“It is not in the NGF’s purview to determine how Melrose or other consultants disburse or utilise the consultancy fee paid to them,” its spokesman, Abdulrazaque Barkindo, said in a statement to PREMIUM TIMES Tuesday.

Mr. Barkindo said the fact that President Buhari had approved a second tranche of the Paris Club loan refund to states was “indicative of his confidence in the NGF for the manner it handled the disbursement of the first tranche of the fund.”

Saraki, aides, associates and the coincidence

In its report, the EFCC highlighted a number of coincidences in the disbursement of the N3.5 billion and past activities of Mr. Saraki.

The EFCC report did not say Mr. Saraki personally moved some of the N3.5 billion.

But while tracking the money, anti-graft detectives found a consistent pattern in the individuals named in the money laundering.

For instance, Mr. Makanjuola, Mr. Saraki’s Deputy Chief of Staff, featured prominently in the alleged laundering of the N3.5 billion.

Mr. Makanjuola once served as a lawmaker from Kwara State.

Last week, he was named in an ongoing corruption case by a former research institute provost who said he gave Mr. Makanjuola and other federal lawmakers a gratification to the tune of N50 million.

Mr. Mbonu, whose firm received the N3.5 billion as “consultancy payment” from NGF, worked at the defunct Societe Generale Bank owned by Mr. Saraki’s family.

Similarly, Tunde Morakinyo, who was named in the report as having allegedly conveyed money for Mr. Saraki in 2014, was a longtime aide to the Senate President.

Past assignments Mr. Saraki was believed to have engineered for Mr. Morakinyo included recommending him as an aide to public officials from Kwara State so as to keep tab on their activities and report back to his principal.

PREMIUM TIMES identified Mr. Morakinyo as a front for Mr. Saraki in this newspaper’s Panama Papers series published last year.

Mr. Morakinyo helped Mr. Saraki conceal substantial amount of money in secret offshore tax havens.

Mr. Saraki also had a history with Dantani Abubakar, whom the EFCC identified as the bureau de change operators whose services were engaged in the deal.

In December 2015, the State Security Service announced the arrest of its personnel who allegedly robbed a bureau de change operator in Abuja of N310 million.

But the secret police was silent on the identity of the victim.

Sahara Reporters later identified Mr. Dantani as the owner of the fund and detailed how he had allegedly served as a regular money changer for Mr. Saraki.

Asides the individuals named, the EFCC also said it established that parts of the N3.5 billion ended up in local and foreign bank accounts allegedly operated by Mr. Saraki.

Big question

Although detectives linked the principal actors to the Senate President, and showed how parts of the money were distributed, they did not say why the NGF would pay Mr. Saraki such an amount.

But they clearly told President Buhari that the NGF paid Mr. Mbonu’s Melrose Services N3.5 billion for onward disbursement to Mr. Saraki – not because the firm rendered any service that was commensurate with such a large payout.

Investigators now believe the money was intended as bribes to senators to stop any possible legislative enquiry into the Paris Club loan refund.

Law enforcement sources said the National Assembly has uncharacteristically kept quiet about the Paris Loan refund despite the fact that it was not budgeted for.

Some of the sources said Mr. Makanjuola was assigned to distribute the money to senators.

In its report about the bureau de change robber incident, Sahara Reporters said Mr. Makanjuola allegedly coordinates Mr. Saraki’s alleged bribe to lawmakers.

Mr. Makanjuola did not respond to repeated requests for comments. Messrs. Morakinyo, Dantani and Mbonu could not be reached for comments.

We didn’t receive any money

But lawmakers denied receiving any payments.

In separate interviews with two senators and four members of the House of Representatives, the lawmakers all described the bribe allegations as untrue.

Ali Wakili, senator representing Bauchi South, told PREMIUM TIMES linking senators to the N3.5 billion deal was “preposterous, wicked and very ungodly.”

Mr. Wakili said the controversy was part of a “syndrome” to sink the Senate President, adding that citizens should focus on “issues that will take Nigeria out of the doldrums.”

“Not these stereotypes, perception rigidity and smear campaigns against the Senate,” he said in an interview Tuesday night.

Another senator, Fatima Raji-Rasaki, said “there’s nothing like that” when asked if she had knowledge of such disbursement.

In the House, Razak Atunwa, from Kwara State, described the allegation as “a manifest falsehood.”

Mr. Atunwa said he would not only vouch for himself but also for some of his colleagues.

“Not only did I not partake in sharing of any money, I can tell you categorically that none of the lawmakers I know and interact with shared such money.”

But Mr. Atunwa said it could be problematic if it was discovered that the presidency had spent such a huge amount of money outside appropriations.

“There are several ways the executive could generate funds to meet up with its obligations, but all expenditure should normally be expected to be captured in the budget.”

Mr. Atunwa said the National Assembly did not interfere in the Paris Club refund because there was no petition in that respect.

“If Nigerians feel public funds are being spent in a manner that they found questionable, we expect them to forward petitions about such and we can then investigate,” Mr. Atunwa said. “So far, we didn’t receive such.”

Investigation continues…

In its report, the EFCC told President Buhari it found strong grounds to prosecute those named in the N3.5 billion, but said investigations were still ongoing.

Some of the beneficiary firms the EFCC investigated included: Mallam Alu Agro Allied Limited, Melrose General Services Co. Ltd, Bizplus Consulting Services Ltd., Bina Consults & Integrated Services, amongst other consultants and legal experts.

EXCLUSIVE: How EFCC linked Saraki, aides to N3.5 billion Paris Club refund